Can help indicate whether the SSN is likely accurate or not and a good supplemental tool for locating addresses linked to the applicant. Even the US Postal Service is not always the safest way to transmit information With all of the new laws about guarding.

Adp Work Opportunity Tax Credit Wotc Avionte Bold

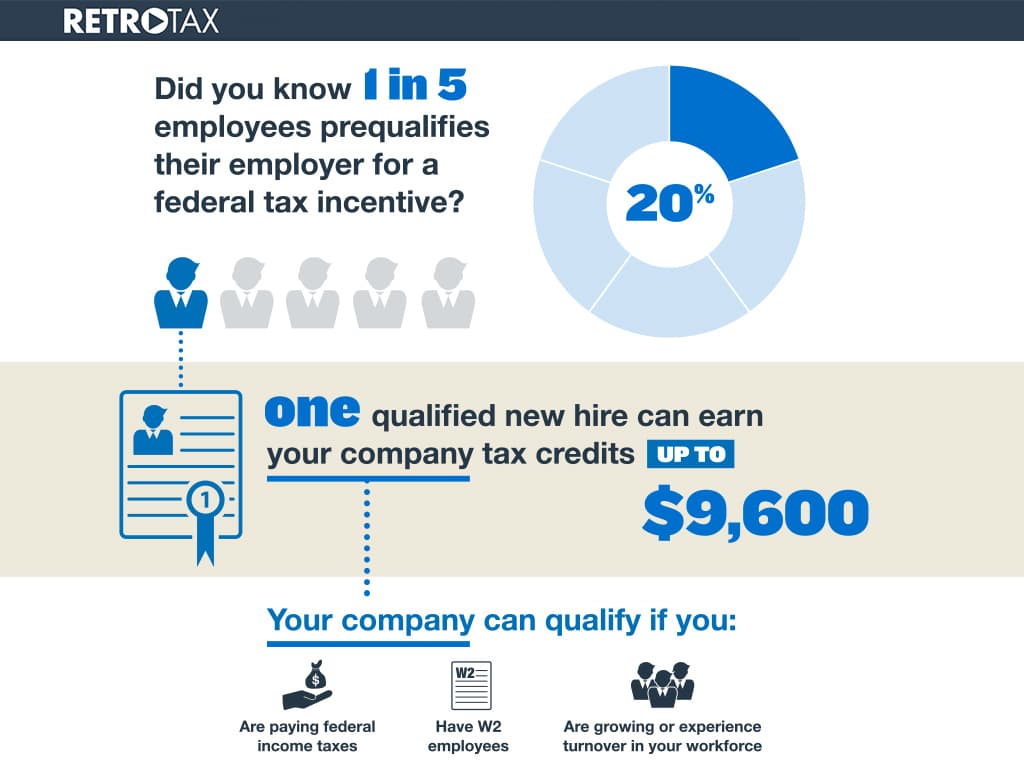

By screening hiring and retaining WOTC qualified employees your business may receive a federal tax credit ranging from 1500 to 9600 per qualified individual based on the certified target group.

. Our team has 60 years of combined domain knowledge and development of industry best practices for maximum tax credit generation. This is the Ernst Youngs vendor survey site. If your business claimed a tax incentive you are required to file an Annual Tax Performance Report previously called the Annual Survey and Annual Report by May 31 of each year.

Hiring certain qualified veterans for instance may result in a credit of. Its asking for social security numbers and all. Its called WOTC work opportunity tax credits.

The amount of the tax credit available under the WOTC program varies based on the employees target group total hours worked and total qualified wages paid. Employers are permitted to ask applicants for their Social Security numbers in all states. Also learn your SSN.

The WOTC survey displays in the current browser window. Do you have to fill out Work Opportunity Tax Credit program by ADP. If you do qualify for the credit for the disabled the amount ranges from 3750 to 7500 depending on your filing status and income.

You wont qualify for the credit. So basically what I am saying is that it sounds like these companies are only fishing for candidates under 40 and that will give them a tax credit. Our executive summary of the employee Social.

If you do not supply the social security number on the application you will likely have to make a trip to the company to fill it in if the employer wants to offer you a job. Make sure this is a legitimate company before just giving out your SSN though. Making energy efficient improvements to your home in order to claim an energy tax credit Taking college or other educational classes in or der to claim the American opportunity tax credit Other please describe.

If you dont file reports due after July 1 2017 on time you will be. I also thought that asking for a persons age was discriminatory. Its asking for social security numbers and all.

Dont email such sensitive information. You wont qualify for the credit. Felons at risk youth seniors etc.

Some companies get tax credits for hiring people that others wouldnt. 3 Tax Credit Eviction. Research Applied Analytics and Statistics RAAS Individual Taxpayer Burden Survey ITB 7312020 2018 Study Mail Online.

Community Experts online right now. The forms require your identifying information Social Security Number to confirm who you are and they ask for your date of birth because some of the target groups are. Tax Pro Account Survey.

02-2021 Catalog Number 57576P irsgov Department of the Treasury - Internal Revenue Service. You receive only 300 in SSDI per month but you have 18000 in an annual taxable disability pension. Online taxpayercustomer experience survey IRSgov Ongoing.

On August 28 2020 the IRS in Notice 2020-65 responded to a Presidential Memorandum executive order by giving employers the option 1 to delay their withholding of the 62 employee share of Social Security and the comparable Railroad Retirement tax for certain employees from September 1 2020 to December 31 2020. LIHTC owners are prohibited from evicting residents or refusing to renew leases or rental agreements other than for good cause. Several states including New York Connecticut and Massachusetts require employers to put safeguards like encryption in place to protect the privacy of job seekers.

However the Society for Human Resource Management advises employers to request. If I put 000-00-0000 or xxx-xx-xxxx to this field - it says Invalid social security number If I dont put any information there and just click Continue - wizard continues. It asks for your SSN and if you are under 40.

For hiring certain disadvantaged applicants. If May 31 falls on a weekend or state holiday your due date is the next business day. I dont think there are any draw backs and Im pretty sure its 100 optional.

I dont feel safe to provide any of those information when Im just an applicant from US. I earned about 800 this year doing online surveys and in-home testing for market research and was wondering if these count toward the Earned Income Tax Credit. Is it safe to put your social security number on an online tax credit screening.

Youre gonna need it. I dont feel safe to provide any of those information when I. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our websites chat box this one from a new hire.

Tenants living in tax credit buildings have good cause eviction protection statewide. I know some companies get these credits from the gov. None of the above.

An extremely powerful effective and revealing search. As of 2020 most target groups have a maximum credit of 2400 per eligible new hire but some may be higher. If you have any technical issues while completing the survey you can easily return to the Tax Credit Check page and re-initiate the survey at any point.

But on Federal Taxes - Health Insurance it doesnt allow me to enter Health Insurance information. Ask Your Question Fast. I dont just give anyone my SSN unless I am hired for a job or for credit.

Instant search used to determine in which counties to conduct a criminal history search. The work opportunity tax credit is a real thing but we only b ask our employees to fill out the survey not applicants. So I am applying at a large well known telecom company and they wont let me advance unless I complete a tax credit screening.

But requesting that I take a survey which asks for my SSN at this level of the application process really doesnt. SSN Verification and Address History Report. The termination notice must state good cause and may include either a serious or repeated violation of the.

Understanding Taxes Earned Income Credit

Child Tax Credit United States Wikiwand

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Retrotax Tax Credit Administration Jazzhr Marketplace

Understanding Taxes Simulation Claiming Child Tax Credit And Additional Child Tax Credit

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

Do You Need Weakly Or Monthly Payslips Or P60 Documents Payroll Template National Insurance Number Unit Rate

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Publication 974 2021 Premium Tax Credit Ptc Internal Revenue Service

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Understanding Taxes Earned Income Credit

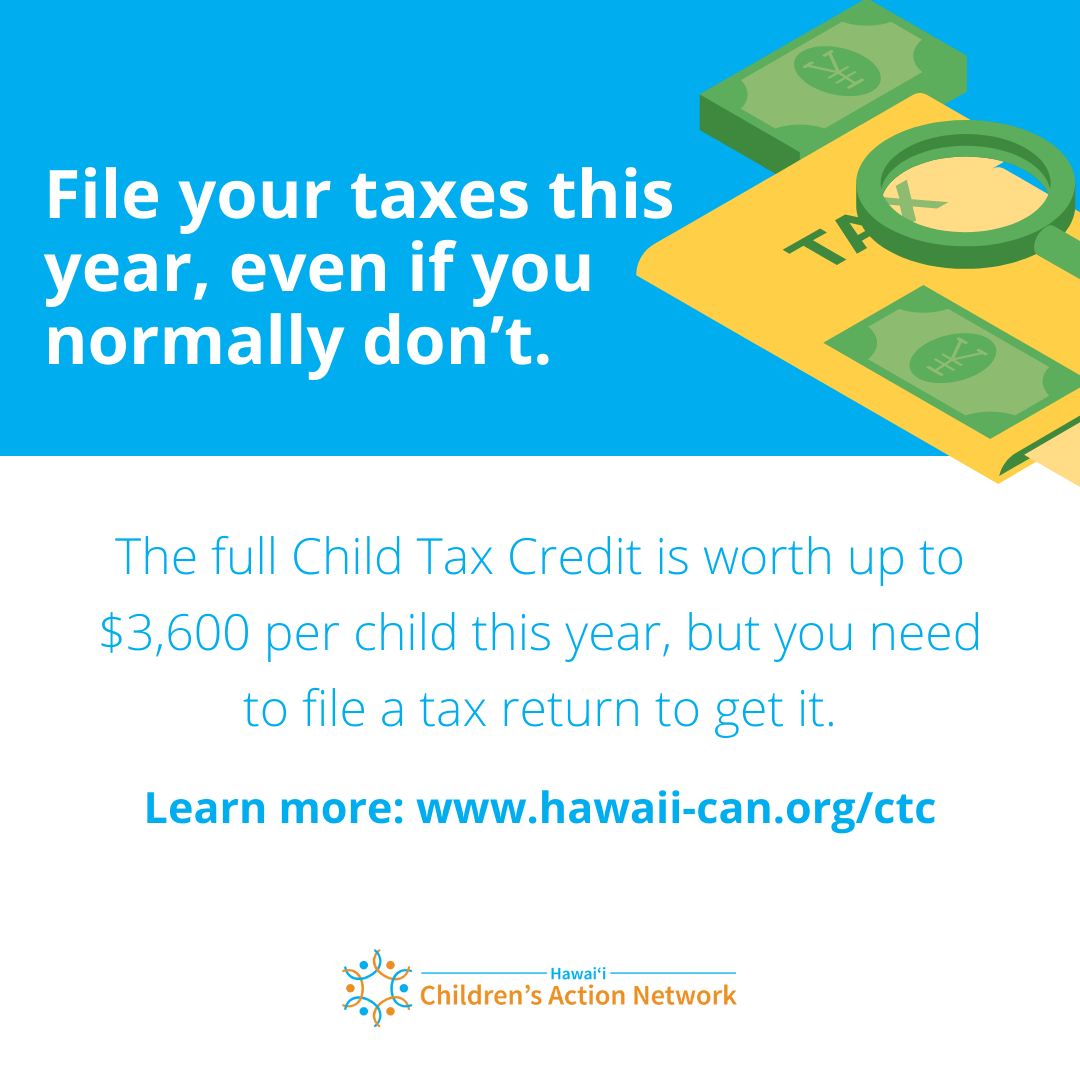

Child Tax Credit Resources Hawaiʻi Children S Action Network

Retrotax Tax Credit Administration Jazzhr Marketplace

Child Tax Credit 2022 Claim 4 000 Payments With No Minimum Requirement To Qualify See How To

Da Form 4856 Download Counseling Example Da Form 4856 For Failure To Report Business Letter Template Doctors Note Template Cover Letter Template Free