Things to know before estate tax laws sunset in 2025. This higher exemption amount has continued to increase indexed for inflation and the exemption in 2021 is 117M.

New Estate Tax Laws For 2021 Youtube

The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of.

. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The tax reform law doubled the BEA for tax-years 2018 through 2025. How did the tax reform law change gift and estate taxes.

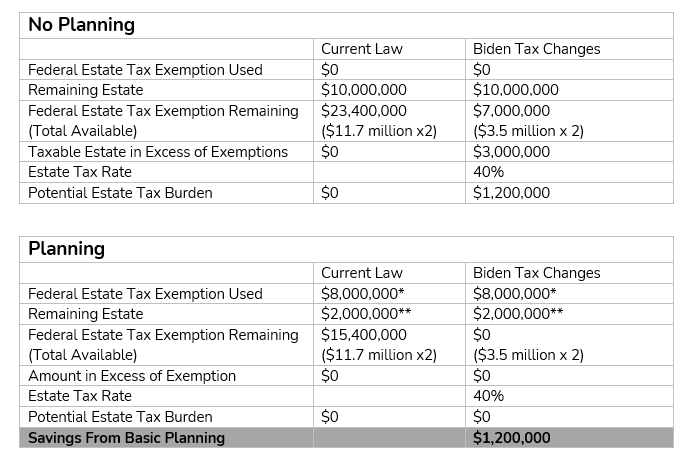

Then the gift and estate tax exemption is lowered from 117 million to 6 million with the gift and estate tax rate increased from 40 to 45 all effective January 1 2022. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The amount of the estate tax exemption for 2022.

Because the BEA is adjusted annually for inflation the 2018. Notably the TCJA provision that doubled the gift. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and Jobs Act of 2017. However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. The current exemption will sunset on Dec.

New York Estate Tax Exclusion. Letss assume the estate tax exemption is still 114 million when Dora dies. Under current law the estate and gift tax exemption is 117 million per person.

However the new tax plan increased that exemption to 1118 million for tax year 2018 rising to 114 million for 2019 1158 million for 2020 117 million for 2021 and. But with new tax laws looming the. After 2025 the TCJA is set to sunset and the exemption.

31 2025 and will return to the Obama exemption of 5 million adjusted for inflation. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. Take Advantage of Exemptions.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. For gifts and estates occurring after Dec. There are 12 states in the.

Families will have to seek to amend and adjust their estate planning prior to the end of 2021 in anticipation of the tax law changes in 2022. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. On January 1 2018 the Tax Cuts and Jobs Act TCJA added provisions to the tax code to reduce income tax burdens.

Estates may apply for an extension of time to file the return pay the tax or both using Form ET-133 Application for Extension of Time to File andor Pay Estate Tax. The Build Back Better bill thats been bouncing around in Congress included a provision that would accelerate the sunset provision so that the exemption would drop to the. IStockphoto The holidays are usually a time of gift-giving.

Here is what you need to know about the proposal. On the contrary because of the scheduled sunset of current estate tax laws in 2026 you should read this article carefully if your estate will likely be worth more than half the. Thus the estate tax rate is 40 and Doras estate is still worth 20 million.

The adjusted exemption in 2026 is projected to. Now that we have completed the good news portion of the post we can move on to the New York estate tax and the 2021 exclusion. 31 2021 the Act would reduce the estate and gift tax exemptions from their present high level and increase the top tax rates as follows.

Estate Taxes Under Biden Administration May See Changes

2021 Tax Laws Federal Tax Updates Maryland Estate Taxes Mcnamee Hosea

Gift And Estate Tax Planning In 2021 Baker Tilly

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Estate Planning Opportunities In 2020 Homrich Berg

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Recent Changes To Estate Tax Law What S New For 2019

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Three Estate Planning Strategies For 2021 Putnam Investments

Congress Readies New Round Of Tax Increases

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

Estate Taxes Under Biden Administration May See Changes

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Biden Tax Plan And 2020 Year End Planning Opportunities